Business Cycle Theory and Ghana’s Economic Recession

Imagine we had no contractions or recessions living with us. This would mean that after every year our GDP would rise, as would investment, high consumer spending, and job creation, often driven by sectors like mining, agriculture, and services. People may feel more secure in their jobs and optimistic about future opportunities. With high investment and consumer spending, many people may experience improved incomes, leading to better living standards. Accompanied by more disposable income, families might invest in education, healthcare, and leisure activities. This reduces unemployment and helps lift people out of poverty, giving them a sense of empowerment and stability.

However, further research and reading led me to realize that there are always two forces in everything we do, leading to two outcomes at the end. Therefore, it is true that a country cannot be stable or in expansion forever. Recession and contraction in the economy must eventually occur. To this day, no economy has avoided contractions, proving it is a natural phenomenon.

Is Ghana's Recession Bouncing Back?

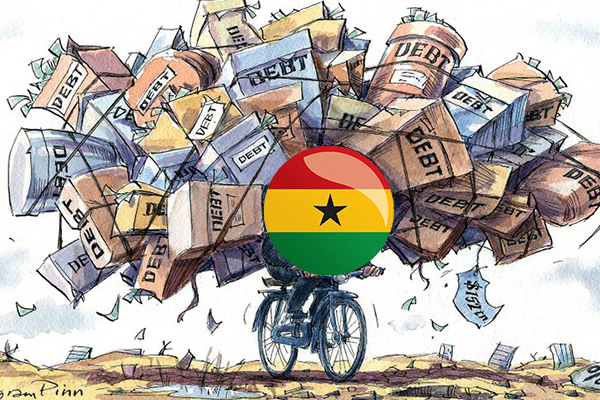

Ghana is indeed facing economic challenges, and recovery seems slow. High inflation, currency depreciation, and government debt have significantly weakened both consumer spending and business investment. The country’s limited fiscal flexibility, caused by high debt levels, reduces the government’s ability to introduce effective stimulus measures to reverse the downturn.

Key Economic Factors

- Government Debt and Fiscal Constraints: Ghana’s elevated public debt limits its ability to implement expansionary fiscal policies, like tax cuts or increased government spending. This makes it difficult for the government to stimulate growth during a recession, leading to slower economic recovery.

- Consumer Spending: High inflation and rising costs of living have reduced household disposable income, forcing consumers to focus on essentials like food and fuel. Reduced consumer spending slows down demand for goods and services, further exacerbating the economic slowdown.

- Business Investment: Businesses, facing reduced revenues and higher operational costs, are cutting back on investments. This decline in business confidence and investment can lead to job losses, further reducing household income and contributing to the recessionary cycle.

- Loss of Consumer and Business Confidence: When confidence in the economy drops, consumers and businesses may reduce spending and investment. This reduction in activity can contribute to a recession.

- Financial Crises: Problems in the financial sector, such as a banking crisis or credit crunch, can lead to reduced lending and investment. This severely impacts economic growth, as businesses and consumers have less access to credit for expansion or purchases.

Factors Limiting Recovery

- Austerity Measures: In an effort to manage debt, the government may resort to spending cuts and tax increases, which could worsen the economic downturn by reducing overall demand.

- Investor Confidence: High government debt and fiscal instability may deter investors, leading to higher borrowing costs and a reluctance to finance the government’s debt. This further limits Ghana’s ability to fund economic recovery initiatives.

Conclusion: Is Ghana's Recession Rebounding?

Given the constraints on fiscal policy, consumer spending, and business investment, it is unlikely that Ghana’s economy will bounce back quickly from this recession. The cycle of reduced spending, cutbacks, and austerity measures suggests that economic recovery will require comprehensive reforms, including measures to control inflation, stabilize the currency, and foster an environment conducive to both consumer and business confidence.

1. Should we still have hope for MOTHER GHANA?

2. Who are we to blame for this recession?